ESG is Lobbyists’ New Buzzword as Dems Mull Mandated Reporting

- Environmental, social, and governance issues get more attention from lobbyists

- Uptick comes as Democrats in House float bills to mandate ESG reporting

By Andrea Vittorio and Andrew Ramonas | August 5, 2019 6:28AM ET

Companies’ approach to environmental, social, and governance issues is getting more attention from lobbyists as Democratic lawmakers float legislation in the space.

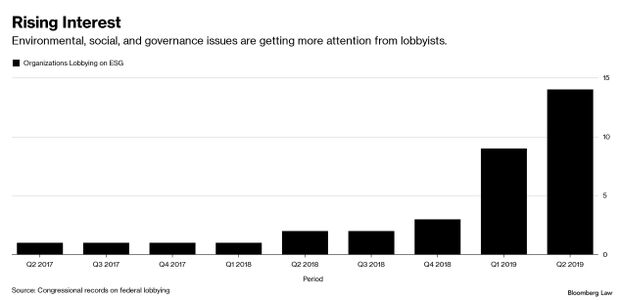

Investors like Vanguard Group joined State Street Corp., the U.S. Chamber of Commerce, and at least 11 other groups that included such issues in their lobbying efforts this past quarter. That’s the highest tally since the phrase or its abbreviation ESG first appeared in lobbying disclosures in 2015, a Bloomberg Law review of filings found.

ESG has become a buzzword as investing that considers environmental, social, and governance factors goes mainstream. Assets in ESG and values-based exchange-traded funds reached $59 billion in mid-June, which is five times 2015’s level, according to Bloomberg Intelligence.

The uptick in lobbying on ESG comes as House Democrats propose bills to make companies report on topics like boardroom diversity and climate change. These proposals, while unlikely to become law under President Donald Trump, are considered a potential preview for what could come if Democrats take control of Congress or the White House after the 2020 election.

“The fact that the House is paying attention to this issue has certainly been an exciting development from where we sit,” said Rachel Curley, who advocates on public policy issues for government watchdog Public Citizen. The group has called on companies to disclose how much money they spend to influence politics as part of its ESG advocacy.

State Street, one of the world’s biggest asset managers, has the most consistent track record of ESG lobbying, the filings show. The firm has disclosed lobbying in connection with ESG aspects of pension-related legislation. State Street is followed in the frequency it has filed lobbying disclosures by the Chamber, a business association skeptical of ESG’s value to companies.

Bloomberg Law looked at lobbying reports for references to ESG or environmental, social, and governance to find the number of organizations that advocated on these issues before the federal government. The filings, submitted to Congress every three months, go up to the second quarter of this year, which ended June 30.

Reporting Rules

ESG first started appearing in lobbying filings in 2015, when the Obama-era Securities and Exchange Commission launched a review of corporate disclosures. Many of the responses to that effort called on the SEC to make the largely voluntary practice of ESG reporting more consistent so that investors could better compare across companies.

More recently, pension funds in California and New York joined academics and other organizations representing more than $5 trillion in assets under management in submitting a petition for an SEC rule requiring ESG disclosure last year. The commission, with its Republican-leaning majority, is unlikely to act on the petition.

One area of ESG where SEC Chairman Jay Clayton has shown interest in improving disclosures is so-called human capital as as a company’s workforce is considered more important in an increasingly knowledge-based economy.

“I think that our disclosure regime should evolve to reflect how companies have evolved,” Clayton told Bloomberg Law July 29. Still, Clayton has said he’s reluctant to mandate metrics because they could vary from one company to the next depending on what’s most relevant to their industry.

Business groups like the Chamber also are wary of required reporting.

“ESG ultimately must be linked to the bottom line,” said Thomas Quaadman, executive vice president of the Center for Capital Markets Competitiveness at the U.S. Chamber of Commerce. The Chamber has lobbied on the issue off and on since 2015.

“We hope that ESG can evolve in a healthy way and not be used as a cudgel against businesses,” Quaadman said in a statement.

Shareholder Proposals

State Street, Vanguard, and other institutional investors that have lobbied on ESG are increasingly pushing companies to act on climate risks or make their boards more diverse. These environmental and social issues have overtaken more traditional governance concerns as top topics for shareholder proposals and engagement.

That’s been met with pushback from groups like Grover Norquist’s Americans for Tax Reform. The right-leaning advocacy group has started a new campaign against what it calls “politically motivated” proposals as part of its lobbying on ESG.

“Our focus is to protect all investors from Washington inserting itself between shareholders and the businesses they invest in,” said James Setterlund, executive director of its new Shareholder Advocacy Forum, said in a statement.

Vanguard declined to comment on its ESG lobbying efforts.

To contact the reporter on this story: Andrea Vittorio in Washington at [email protected] and Andrew Ramonas in Washington at [email protected]

To contact the editor responsible for this story: Seth Stern at [email protected]